CarTrade continued its dream run in Q2 FY26. The online car marketplace more than doubled its net profits YoY during the quarter on the back of growing revenues, improving margins and a tight leash on its expenses. The company also achieved its highest-ever quarterly revenue, signalling robust growth across segments.

Here’s a quick snapshot of CarTrade’s second quarter results:

- Net profits more than doubled YoY to INR 64.1 Cr

- Revenue from operations grew 25% YoY to INR 193.4 Cr

- EBITDA improved 94% YoY to INR 63.6 Cr

- Total expenses rose 5.3% YoY and 0.4% QoQ to INR 142.2 Cr

Strength Across Verticals: CarTrade’s diversified revenue model continued to prove its worth. The consumer business, anchored by CarWale and BikeWale, accounted for the lion’s share of the top line and profits. Furthermore, the 2023 acquisition of OLX India’s classifieds business appears to be validating the company’s strategy, contributing INR 55.5 Cr to the top line.

Operationally, too, the company attracted 85 Mn average monthly unique visitors in the quarter, 95% of whom arrived organically.

Onwards & Upwards? Meanwhile, succession planning appears to be underway at CarTrade. Cofounder Vinay Sanghi’s son, Varun Sanghi, has now been appointed as the company’s new chief strategy officer. All said and done, the positive results are expected to give a further boost to CarTrade’s stock, which has more than doubled on a YTD basis. The stock gained by more than 17% in Tuesday’s session, hitting a 52-week high.

With the auto marketplace firing on all cylinders, can it maintain this growth trajectory while defending its turf against well-funded competitors? While that is a question for another day, here is how CarTrade fared on the financial front in Q2.

From The Editor’s Desk ? Snabbit To Raise A $30 Mn War Chest- The quick service startup is raising INR 265 Cr in its Series C round led by Bertelsmann Nederland BV, with participation from other existing backers, to meet its working capital requirements.

- The funding comes just weeks after the company shifted its headquarters from Mumbai to Bengaluru, signalling the company’s intent to drive operational scalability and shore up talent acquisition.

- Founded in 2024, Snabbit connects users with verified cleaners, cooks, and dishwashers within 10–15 minutes through its app. It currently claims to serve over 6,000 families across major metros.

- The AI giant is temporarily scrapping subscription fees for its ChatGPT Go plan, making it free for one year for Indian customers.

- The India-specific plan, initially launched at INR 399 per month in August, gives users access to GPT-5 capabilities. Within just a month, paid subscriptions in India doubled, pushing OpenAI to expand the plan to 89 countries.

- By offering limited-time free access, OpenAI appears to be driving mass onboarding to fuel future monetisation avenues and deepen user trust in the complex and competitive Indian AI market.

- The online travel aggregator slipped into the red in Q2 FY26, reporting a net loss of $5.7 Mn as against a net profit of $17.9 Mn in the year-ago quarter. Despite this, operating revenue rose 9% YoY to $229.3 Mn during the quarter.

- The company attributed the loss primarily to notional accounting expenses arising from its $3.1 Bn capital raise, which dented net profit despite zero cash outflow.

- The fundraise in June was aimed at consolidating control and simplifying its shareholder structure by buying back 34.4 Mn shares from Trip Group, its long-time Chinese investor.

- The contract manufacturing startup has sued its former executive Anirudh Reddy Edla and his startup Ayr Energy for allegedly misappropriating trade secrets and confidential business data to launch a competing venture.

- Zetwerk claims that Ayr’s actions led to nearly $77 Mn in lost customer contracts for the company, adding that Ayr’s rapid growth, over $250 Mn in contracted orders within months, was built on the back of “stolen” data from Zetwerk.

- The lawsuit comes months after the company deferred its IPO plans, and pushed the timeline for its $500 Mn D-Street listing to 2027.

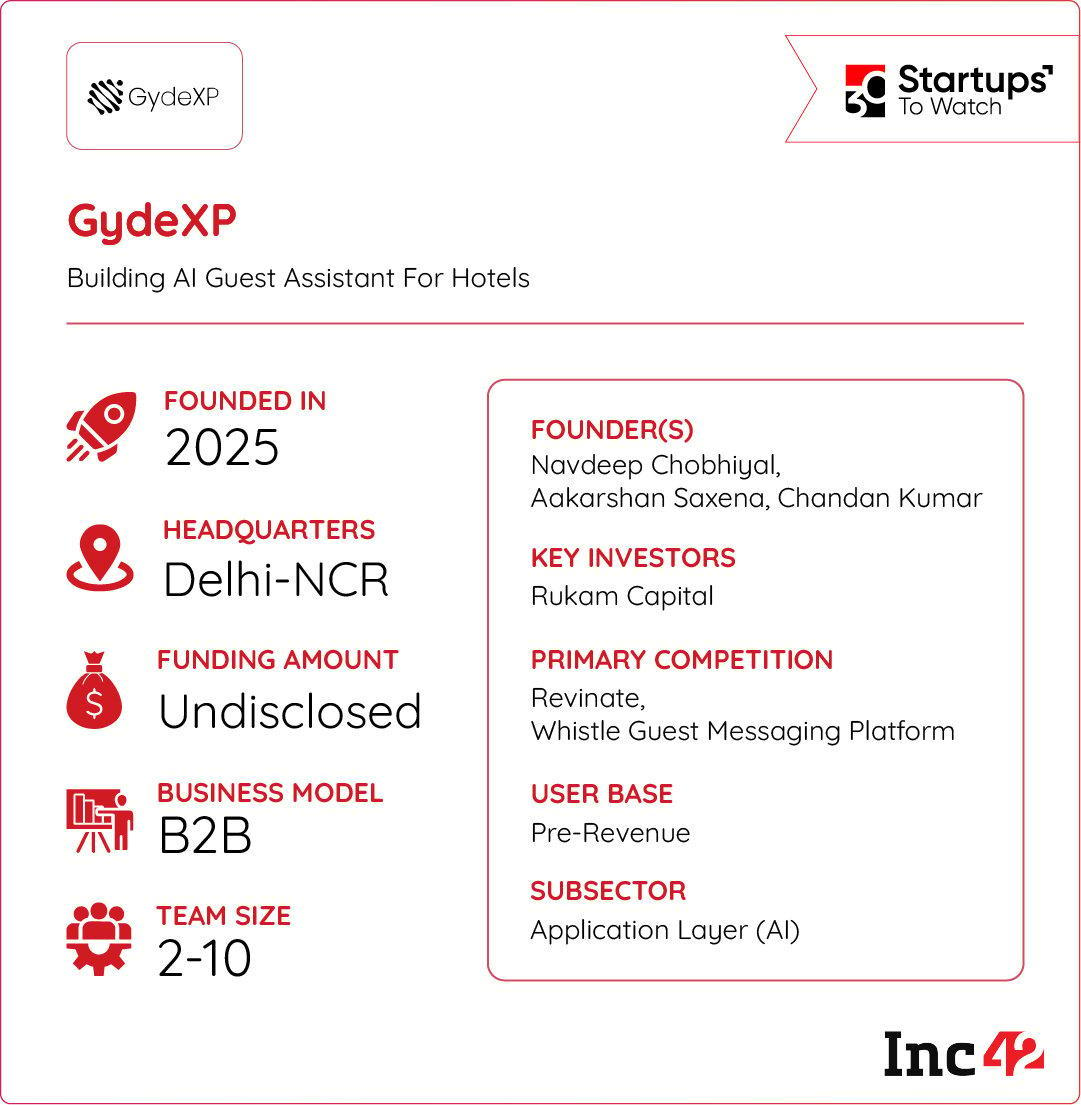

Fragmented guest experience continues to be the bane of the hospitality sector. Delayed responses and language gaps can easily turn a pleasant stay into a lost opportunity. Enter GydeXP, a startup that offers hotels the tools to deliver warm, contextual, and efficient interactions.

From Frustration To Innovation: Founded in 2024, GydeXP has developed “Travel Studio,” an AI-powered platform that acts as a digital concierge for hotels and rental businesses. The solution brings together voice-based AI agents, real-time task tracking, and multilingual communication. This enables seamless service from check-in to post-checkout. For hotel operators, this means better queue management, smarter service assignment, and automated upselling without compromising the personal touch.

Scaling Guest Delight: Targeting hotels and short-term rentals across India and Southeast Asia, GydeXP blends AI with hospitality, helping property operators redefine how guests are cared for while boosting operational profitability. As AI becomes the unseen concierge behind modern hospitality, can GydeXP’s tech stack deliver the emotional intelligence that makes human service unforgettable?

IPO-bound Lenskart swung back to profitability in Q1 FY26. Yet, its expenses rose a nifty 17% YoY to INR 1,800 Cr+. So, how did the omnichannel eyewear giant spend its money during the quarter?

The post CarTrade’s Q2 Scorecard, Snabbit’s $30 Mn War Chest & More appeared first on Inc42 Media.

You may also like

Netanyahu strikes Gaza: Trump explains why Israelis should hit back; maintains 'nothing would jeopardise ceasefire'

Free Fire MAX redeem codes today, October 29: Unlock exclusive rewards, skins, and bundles

'I watched Jonathan Creek for the first time and noticed one thing in seconds'

India rejects 'biased' UN report claiming Pahalgam massacre influenced treatment of Rohingya refugees

Reeza Hendricks, Bosch Shine as South Africa Beat Pakistan by 55 Runs